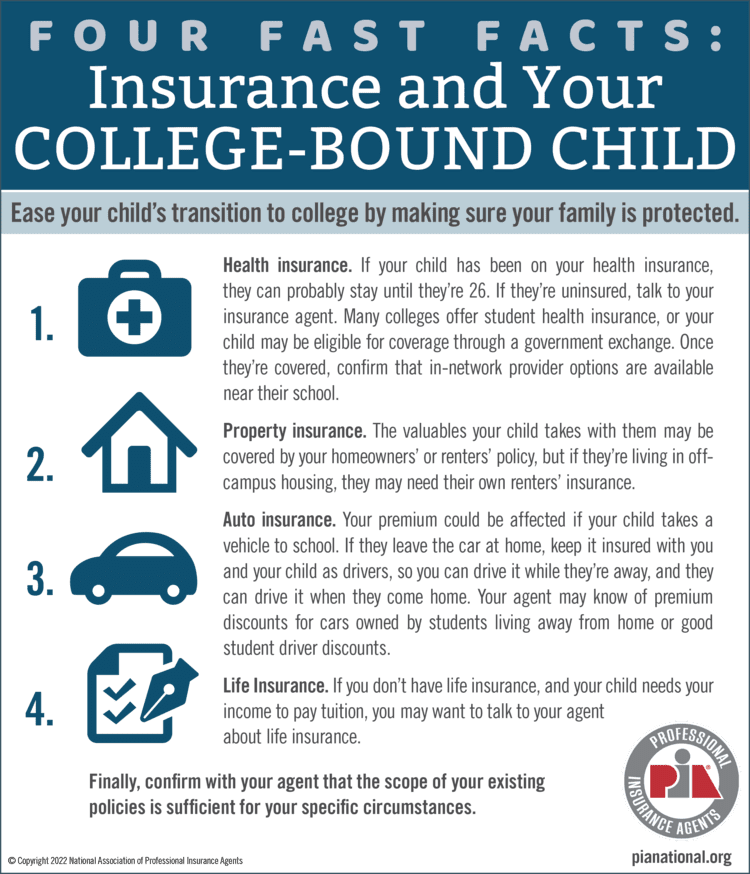

Do you have kids headed off to college later this month? Do you know what insurance issues their departure will raise? We highly recommend reaching out to Your Friends In The Insurance Business at Ieuter Insurance Group before they depart to confirm that the scope of your existing policies is sufficient for your specific circumstances.

Chances are, your child can continue to be on your health insurance until they're 26, but it's always best to discuss this with your agent and to make sure that in-network provider options are available near the school they'll be attending. It's a good idea to establish a health care provider in advance before a need crops up for a visit.

It's more likely that your child's property insurance needs will change. The valuables your child brings to college may be covered, but if they're living on campus they'll probably need their own renters' insurance.

If your child brings their vehicle to school, it's also probable that you'll need to alter your auto insurance coverage to reflect the vehicle's primary location changing.

Lastly, you might want to talk to your agent about adding life insurance coverage to ensure your child will have the funds they need to pay tuition in the case of your death.

Thank you to our partners at the National Association of Professional Insurance Agents for this helpful guide to changing insurance needs for college-aged children.

For all your insurance needs, visit us at https://www.ieuter.com

Ieuter Insurance Group - 414 Townsend St Midland MI 48640

(989) 487-1758

Social accounts:

https://www.facebook.com/ieuterinsurancegroup/

https://twitter.com/ieuterinsurance

https://www.linkedin.com/company/ieuter-insurance-group/

https://www.instagram.com/ieuterinsurance/